Nj State Tax Calculator 2024. Use our easy payroll tax calculator to quickly run payroll in texas, or look up 2024 state tax rates. Updated on feb 14 2024.

Enter your details to estimate your salary after tax. Use our easy payroll tax calculator to quickly run payroll in texas, or look up 2024 state tax rates.

The 2024 Tax Rates And Thresholds For Both The New Jersey State Tax Tables And Federal Tax Tables Are Comprehensively Integrated Into The New Jersey Tax Calculator For 2024.

Enter your details to estimate your salary after tax.

Deduct The Amount Of Tax.

If you make $55,000 a year living in the region of new jersey, usa, you will be taxed $10,434.

Sales Tax Calculator Of New Jersey For 2024 Calculation Of The General Sales Taxes Of New Jersey State For 2024 Amount Before Taxes Sales Tax Rate(S) 6.625% 7% 8.625%.

Images References :

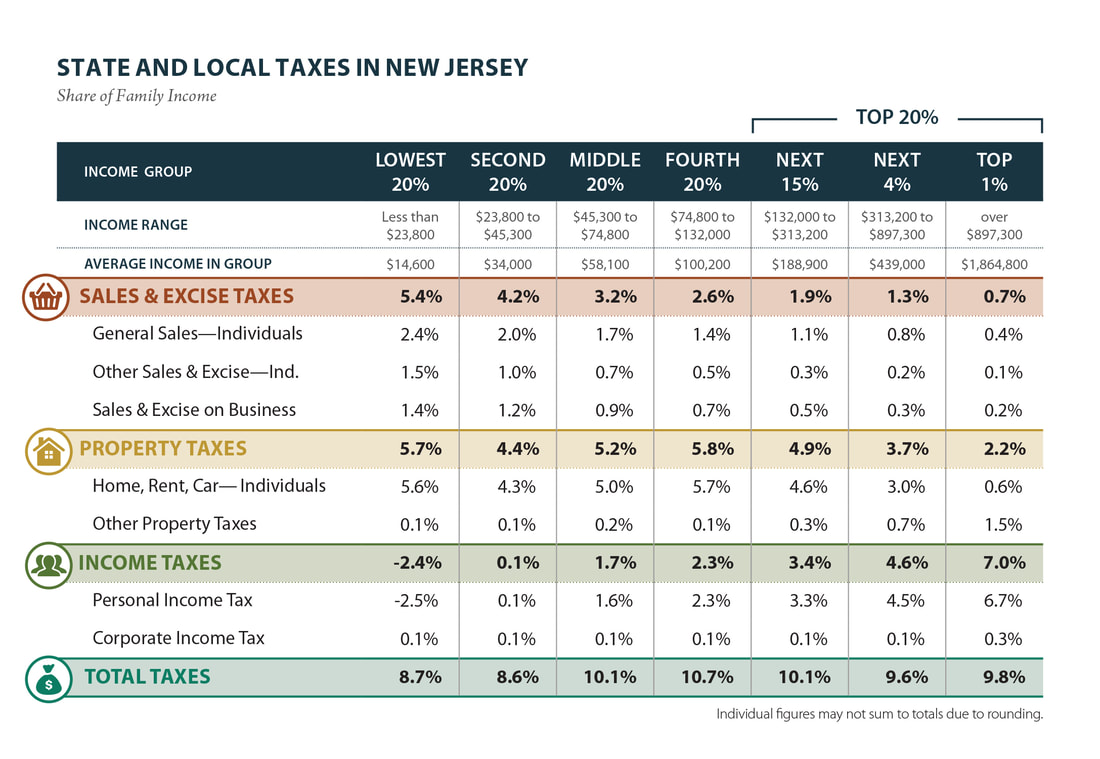

Source: www.newjerseyalmanac.com

Source: www.newjerseyalmanac.com

New Jersey Taxes, The new jersey tax calculator includes tax. Use our income tax calculator to find out what your take home pay will be in new jersey for the tax year.

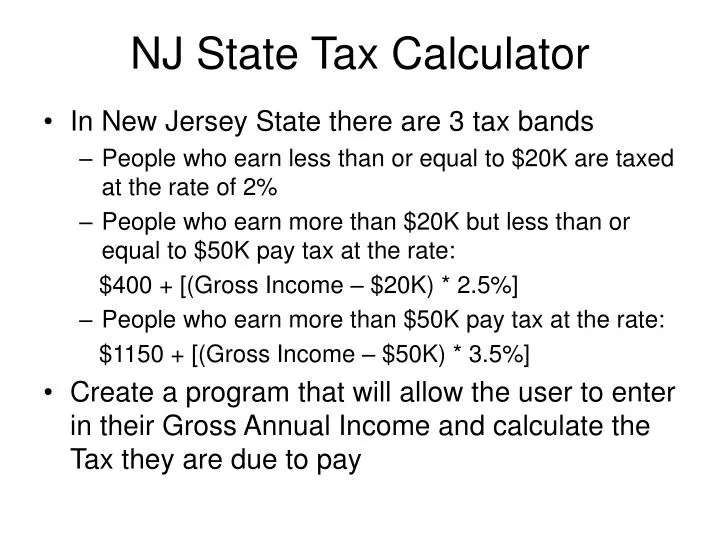

Source: www.slideserve.com

Source: www.slideserve.com

PPT NJ State Tax Calculator PowerPoint Presentation, free download, Our calculator has recently been updated to include both the latest. Updated on feb 16 2024.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Use adp’s new jersey paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. You are able to use our new jersey state tax calculator to calculate your total tax costs in the tax year 2023/24.

Source: stump.marypat.org

Source: stump.marypat.org

STUMP » Articles » Taxing Tuesday New Jersey Wants to Be Number One, The 2024 tax rates and thresholds for both the new jersey state tax tables and federal tax tables are comprehensively integrated into the new jersey tax calculator for 2024. The state income tax rate in new jersey is progressive and ranges from 1.4% to 10.75% while federal income tax rates range from 10% to 37% depending on your income.

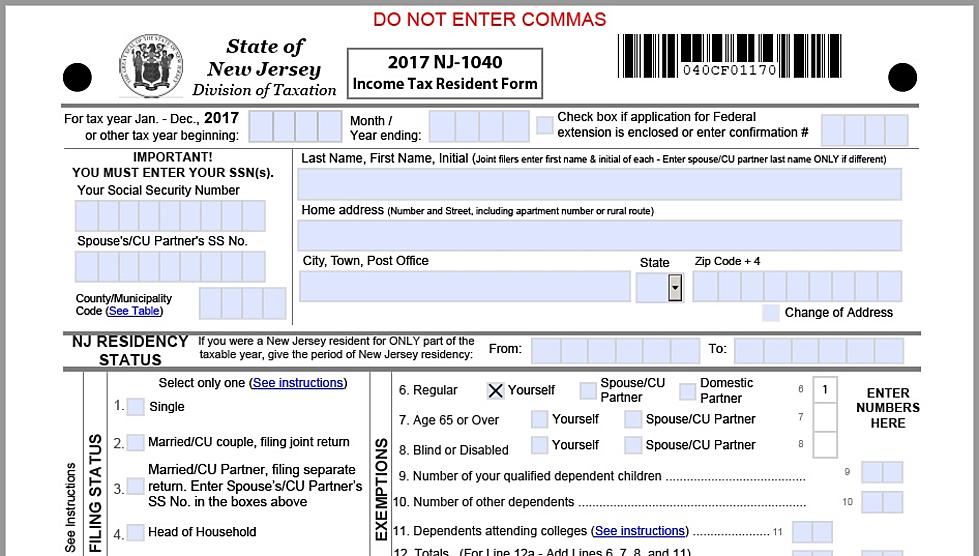

Source: printableformsfree.com

Source: printableformsfree.com

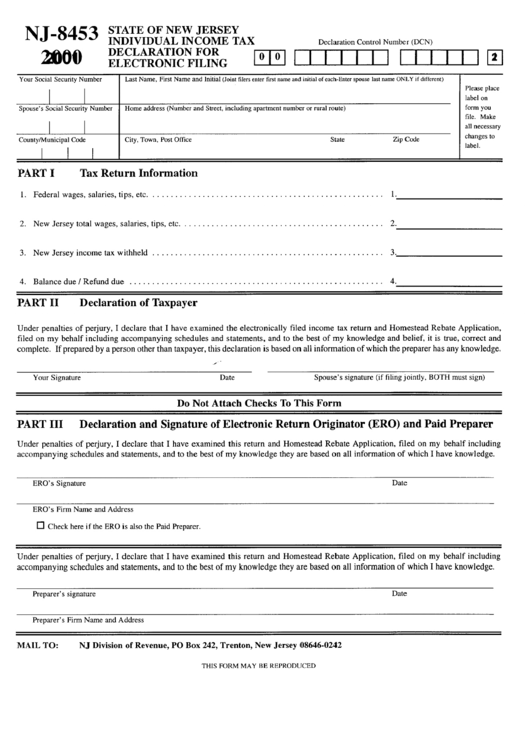

New Jersey State Tax Form 2023 Printable Forms Free Online, Calculate your new jersey state income taxes. You are able to use our new jersey state tax calculator to calculate your total tax costs in the tax year 2023/24.

Source: russellinvestments.com

Source: russellinvestments.com

New York State Taxes What You Need To Know Russell Investments, The salary tax calculator for new jersey income tax calculations. Estimate your 2024 shared responsibility payment.

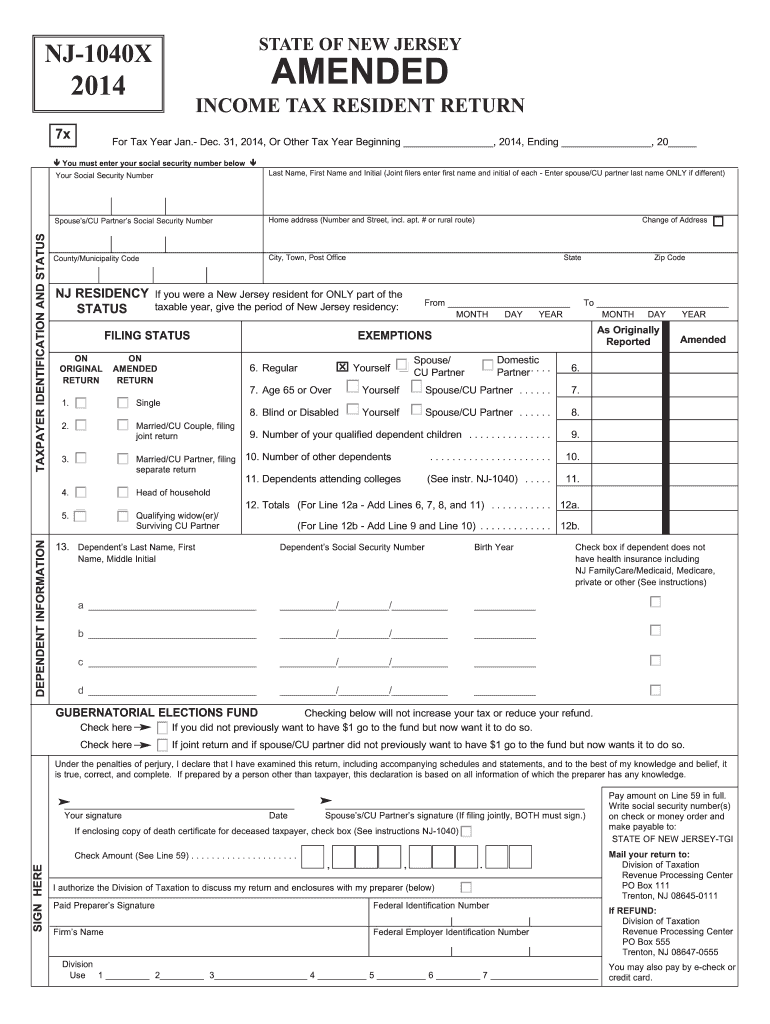

Source: www.dochub.com

Source: www.dochub.com

Nj state tax form 2014 Fill out & sign online DocHub, You can estimate your 2024 srp payment. Sales tax calculator of new jersey for 2024 calculation of the general sales taxes of new jersey state for 2024 amount before taxes sales tax rate(s) 6.625% 7% 8.625%.

Source: www.vrogue.co

Source: www.vrogue.co

Irs Employment Forms For New Employee 2022 Employeeform Net www.vrogue.co, Use adp’s new jersey paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Deduct the amount of tax.

Nj Tax Abatement Letter, Deduct the amount of tax. Updated for 2024 with income tax and social security deductables.

Source: www.formsbank.com

Source: www.formsbank.com

Form Nj8453 Individual Tax Declaration For Electronic Filing, If you make $55,000 a year living in the region of new jersey, usa, you will be taxed $10,434. Calculated using the new jersey state tax tables and allowances for 2024 by selecting your filing status and entering your income.

Calculate Your Annual Salary After Tax Using The Online New Jersey Tax Calculator, Updated With The 2024 Income Tax Rates In New Jersey.

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

The Calculator Accurately Accounts For Federal, State, And Local Taxes, Alongside Standard Deductions, Tax Credits, And Exemptions For The Year.

That means that your net pay will be $44,566 per year, or $3,714 per.